A Quick Answer: To apply for state and federal historic preservation tax credits for roofing, the owner must document the roof’s existing conditions, prepare preservation-compliant rehabilitation plans, and submit a coordinated application through the State Historic Preservation Office (SHPO) and the National Park Service (NPS). Both these agencies review the project to ensure that all roofing work meets the Secretary of the Interior’s Standards for Rehabilitation before any tax credits can be approved. |

The introduction of the federal Historic Rehabilitation Tax Credit, which provides a 20 percent credit for approved rehabilitation work, has encouraged more owners to consider traditional roofing materials such as slate, copper, clay tile, and other period-appropriate systems that meet preservation guidelines.

This incentive supports projects that protect historic character, making roofing rehabilitation a strong candidate for federal review.

Readers searching for clarity often want to understand how these programs operate, where roofing fits into the eligibility criteria, and what steps are required before work can begin. This guide focuses on those fundamentals.

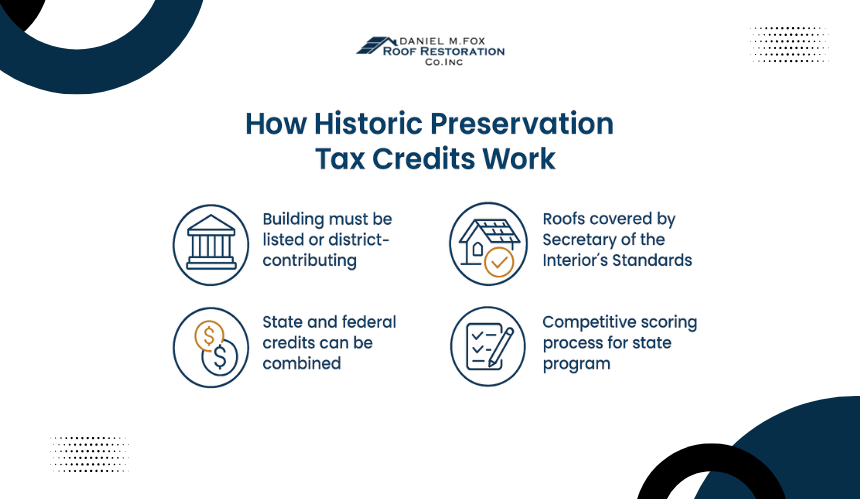

Step 1: Understand How Historic Preservation Tax Credits Work

Before beginning an application, owners must understand how preservation tax credits are structured and why roofing projects often fall within eligible rehabilitation work. This foundation helps ensure that every decision made later aligns with state and federal review expectations.

What Qualifies a Building as a Historic Property for Tax Credit Eligibility?

A property is considered historic when it is listed on the National Register of Historic Places or contributes to a recognized historic district. The State Historic Preservation Office verifies this status by reviewing district boundaries, nomination records, and the building’s architectural or historical significance. This verification confirms that the project can be evaluated within the preservation tax credit framework.

Why Roofing Work Often Meets Historic Preservation Criteria?

Roofs play a central role in protecting a building’s historic fabric, which makes roofing rehabilitation one of the most commonly approved project types.

Programs recognize that traditional materials such as slate, copper, clay tile, and wood shingles maintain the structure’s character. Projects that use compatible materials and retain defining features usually align with preservation expectations from the start.

How Preservation Standards Influence the Way Roofing Rehabilitation Must Be Planned?

All roofing work submitted for tax credits must meet the Secretary of the Interior’s Standards for Rehabilitation. These standards prioritize retaining original materials when feasible and using appropriate replacements when deterioration makes repairs impossible.

Reviewers analyze the roof’s profile, patterns, textures, flashing details, and visible features to confirm that the proposed work supports long-term preservation.

How Massachusetts Historic Rehabilitation Tax Credits Work?

Massachusetts currently offers a Historic Rehabilitation Tax Credit (MAHRTC) program that provides a tax credit of up to 20% of qualified rehabilitation expenditures (QREs) for certified historic properties.

Applicants often ask whether they can combine the state credit with the federal 20 percent program, and the answer is yes. Properties that meet both state and federal requirements can receive both incentives, since each program is administered independently.

The Massachusetts program includes an annual statewide cap, which means credits are awarded through a competitive scoring process until funds are fully allocated for the year.

This structure encourages owners to submit well-documented projects that clearly demonstrate preservation value and readiness.

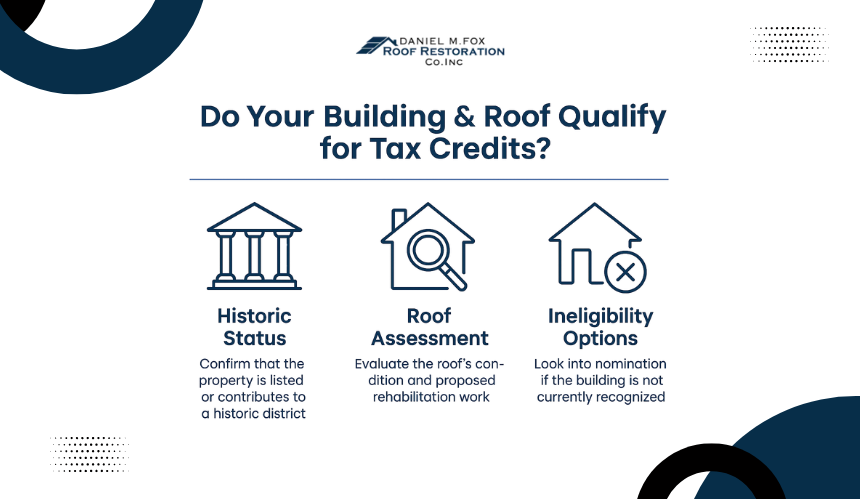

Step 2: Determine Whether Your Building and Roof Qualify for Tax Credits

After understanding how the programs operate, the next step is confirming whether your building and roofing project meets the eligibility criteria.

This stage focuses on evaluating designation status, assessing the roof’s condition, and determining whether planned work aligns with preservation requirements.

How to Verify That Your Building Meets Historic Status Requirements?

Eligibility begins with confirming whether the building is officially recognized as historic. Owners can review National Register listings, consult district maps, or request confirmation from the State Historic Preservation Office.

SHPO helps verify whether the building contributes to a district or holds individual significance, which establishes whether the project can move forward under the credit program.

What Determines Whether Your Roofing Project Qualifies for Rehabilitation Credits?

Roofing projects qualify when the proposed work preserves the building’s character and uses materials that match or closely align with original components. Eligible activities typically include repairing existing materials, replacing deteriorated elements in kind, and restoring compatible flashing or drainage systems.

Work that introduces non-historic substitutes or alters the roof’s appearance usually does not meet program requirements.

What to Do If Your Property Does Not Qualify for Tax Credits?

If the building is not recognized as historic, owners may explore the nomination process through SHPO. Some properties are eligible for listing even if they are not yet documented. When nomination appears appropriate, SHPO guides owners through a structured review that may include:

- Preparing a detailed architectural description

- Compiling historical photographs, maps, and supporting documents

- Demonstrating the property’s significance within a relevant context

- Submitting the completed package to SHPO for review before it advances to the National Park Service

The review period commonly ranges from six to twelve months, depending on the complexity of the nomination. If the building is eventually listed, owners can pursue tax credits for future roofing or rehabilitation projects.

How Preservation Professionals Evaluate the Roof Before Application Submission?

Many owners request an assessment from a preservation architect or roofing specialist before preparing documents. A historic roof preservation specialist evaluates structural stability, water management systems, material deterioration, and overall roof integrity.

Their findings help identify which repairs qualify as rehabilitation work and ensure that the project plans align with the standards required for tax credit review.

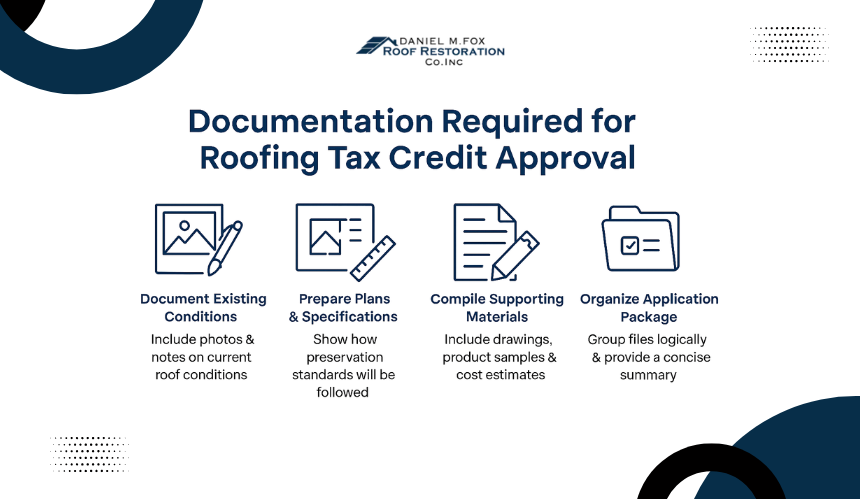

Step 3: Prepare Documentation for Your Roofing Rehabilitation Plan

Once eligibility is confirmed, the next step is preparing the documentation that will support your tax credit application. Review agencies rely on clear evidence, detailed plans, and accurate descriptions to understand how the roofing work preserves the building’s character.

Strong documentation reduces delays during the review cycle and helps ensure that the proposed work aligns with state and federal preservation requirements.

What Existing Conditions You Need to Document Before Planning Roofing Work?

Before drafting any rehabilitation plan, owners must document the roof’s current condition with clear and accurate evidence. This includes wide-angle photos of the overall structure, close-up images showing areas of deterioration, and notes that explain where water damage, flashing failures, or material decay have occurred.

Many owners also include recent inspection reports, which help reviewers understand the severity of the issues. This baseline record becomes the foundation for justifying the proposed scope of work.

How to Create Roofing Plans That Align With Preservation Standards?

Roofing plans must show how the proposed materials, design details, and repair techniques support long-term preservation. Plans should include material specifications, installation methods, and any structural adjustments needed for safety.

Reviewers also look for diagrams or construction drawings that reflect accurate slopes, patterns, flashing treatments, and drainage paths. Aligning these plans with the Secretary of the Interior’s Standards helps demonstrate that the work will protect the building’s historic integrity.

What Supporting Documents You Must Include for SHPO and NPS Review?

Both SHPO and the National Park Service require comprehensive supporting materials that show how the project meets eligibility and compliance expectations. Owners typically submit architectural drawings, product samples or brochures, historical photographs, cost estimates, and written descriptions of each repair task.

These documents allow reviewers to compare existing conditions with the proposed work and evaluate how each element supports the preservation goals of the project.

How to Organize Your Preservation Credits Application Materials for Faster Review?

Clear organization helps reviewers process the application without confusion. Owners often prepare labeled folders for photos, drawings, written descriptions, and material samples. Grouping documents by topic makes it easier for SHPO and NPS teams to assess the project’s intentions and verify compliance.

A concise summary describing how the roofing work meets preservation standards can also speed up review times and reduce the need for clarifications.

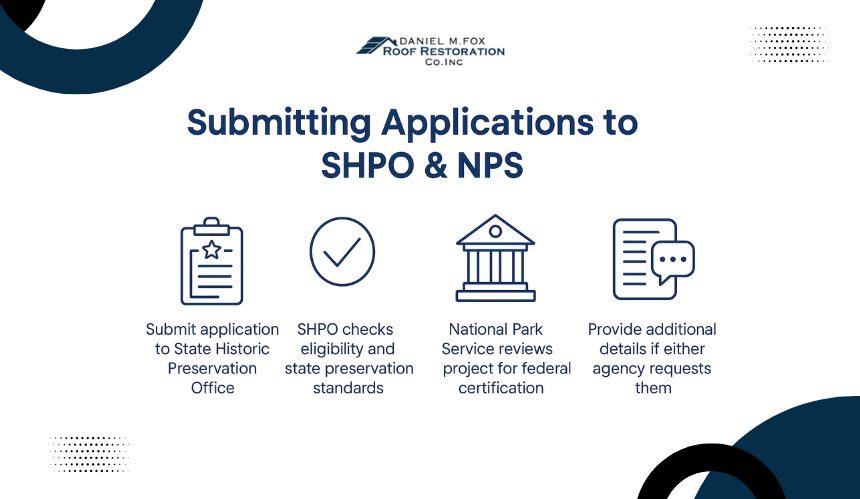

Step 4: Submit Applications Through SHPO and NPS for Review

Once your documentation is organized and aligned with preservation standards, the next step is submitting the application for official review. Both SHPO and the National Park Service evaluate different parts of the project, so accuracy and clarity are essential for a smooth process.

How to Submit Your Application to SHPO for Initial Review?

All applications begin with your State Historic Preservation Office. Owners submit the required forms, roofing plans, and supporting documents directly to SHPO.

The office checks whether the project meets state criteria and verifies that the proposed roofing work preserves significant architectural features. SHPO also prepares recommendations that will be forwarded to the National Park Service for the federal review phase.

What NPS Reviews During the Federal Certification Process?

After SHPO approval, the National Park Service determines whether the project qualifies for the federal tax credit program. NPS reviews how the work aligns with the Secretary of the Interior’s Standards and compares existing conditions to the proposed rehabilitation.

They evaluate roofing materials, construction methods, and visual consistency to ensure that historic character is preserved.

How to Respond When SHPO or NPS Requests Clarifications?

Review agencies may request additional information if something in the application is unclear. Owners often respond by providing more detailed photos, revised drawings, or refined material descriptions. Clear communication helps prevent delays and ensures that both state and federal reviewers have everything needed to certify the project.

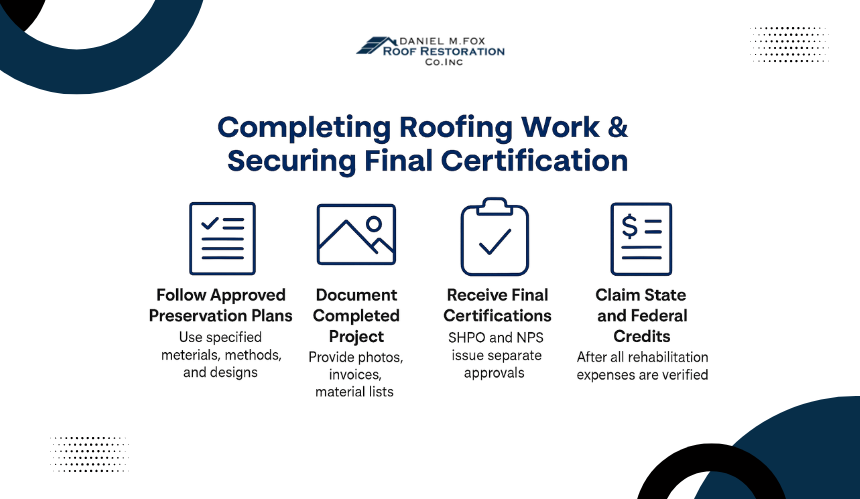

Step 5: Complete Approved Roofing Work and Secure Final Certifications

Once the application receives preliminary approval, owners can proceed with the roofing work. This step requires strict adherence to the plans previously submitted to SHPO and NPS, since deviations can jeopardize the final certification.

How to Ensure Roofing Work Matches the Approved Preservation Plans?

Roofing contractors must follow the exact materials, construction methods, and design details outlined in the approved documentation. Any unapproved substitutions or visual changes can cause the project to lose eligibility.

Property owners should maintain regular communication with preservation consultants throughout the construction phase to confirm that all work remains compliant.

What Documentation You Need After the Roofing Work Is Completed?

After construction, owners must prepare a final set of documents that demonstrate exactly how the work was performed. This includes updated photographs, contractor invoices, material lists, and written summaries describing each completed task. Review agencies use this final package to confirm that the completed project matches the approved rehabilitation plans.

How to Receive Final Certification for State and Federal Credits?

SHPO and NPS each issue separate approvals after reviewing the final work. Once NPS completes the Part 3 review, the federal credit can be claimed on applicable tax filings. For Massachusetts applicants, the state issues credit certificates once all requirements are met, including verification of qualified rehabilitation expenses.

If you are preparing a historic roofing project and want guidance through the documentation, material selection, or tax credit process, Daniel Fox Roofing Inc. is here to help you move forward with confidence.

Our experience with traditional roofing systems and preservation-focused planning ensures your project aligns with federal and state standards from the very beginning.

Frequently Asked Questions

Can repairs qualify for historic roof credits if only part of the roof needs rehabilitation?

Yes. Partial repairs can qualify as long as the work preserves historic materials, follows approved preservation methods, and does not change the roof’s appearance. Reviewers focus on whether the repair addresses genuine deterioration while maintaining the building’s character.

Are flat roofs eligible for historic preservation tax credits?

Flat roofs can be eligible when they are original features of the building and contribute to its historic design. To qualify, any rehabilitation must use materials and construction details that match the building’s established character and drainage patterns.

Do modern insulation or energy upgrades affect the roofing tax credit eligibility?

Insulation upgrades are often acceptable if they do not alter exterior roof features or damage historic materials. Reviewers look closely at whether the upgrade is hidden from view and installed in a way that protects the building’s historic fabric.

Can homeowners apply, or are these credits limited to commercial buildings?

Federal credits apply to commercial and income-producing residential buildings, including rental properties. Owner-occupied single-family homes are not eligible for the federal program, although some states may offer separate homeowner incentives.

How long does the tax credit application and review process take?

The federal review process typically takes several months, depending on project complexity and reviewer workload. State programs, including those in Massachusetts, may require additional time because they operate with annual caps and competitive scoring systems.